Welcome to a Special Edition of the Professional Accountants in Business Committee eNews—Accounting for Natural Capital.

- Overview

- Where Does the Accountancy Profession Fit it In?

- A Macro View of Natural Capital Risk

- Business Case for Natural Capital Management

- The TEEB for Business Coalition

- Tracking a Carbon Bubble

- Innovative Organizations

Other Activities and Resources

1. Overview

Attention from the accountancy profession on natural capital accounting is rapidly increasing in response to concern about the potential for systemic risk of climate change and environmental externalities that affect organizational, market, and societal sustainability.

Sustainable economies depend on sustainable organizations. To be viable over time, the ecosystems and resources organizations depend on need to be maintained and enhanced. Yet when it comes to the natural environment, we are seeing a rapid depletion of capital and resources, as well as the risk of a financial “carbon bubble” due to the potential limitations on what percentage of global fossil fuel reserves can be burned (see Tracking a Carbon Bubble for additional information).

This loss of natural capital is posing a new array of threats and opportunities to business ranging from competition for access to resources, and tightening regulation. Therefore, the time has come for organizations in the public and private sectors to adapt to a world of increasingly scarce natural resources.

2. Where Does the Accountancy Profession Fit it In?

Factors that are economically invisible contribute to natural capital depletion. Many environmental impacts are externalities because they are not accounted for in market economics. Government and business alike are starting to recognize the importance of measuring and valuing natural capital. Widely accepted standards for measurement and valuation would help organizations implement natural capital management and facilitate consistency and comparability across organizations.

Natural capital assets broadly fall into two categories: those that are non-renewable and traded, such as fossil fuel and mineral commodities, and those that provide finite renewable goods and services for which no price typically exists, such as clean air, groundwater, and biodiversity. Natural capital is the stock of capital derived from biological diversity and ecosystems as well as natural resources such as fossil fuels.

Is Natural Capital a Material Issue? by the Association of Chartered Certified Accountants, KPMG, and Fauna and Flora International demonstrates the lack of a standardized business case for considering biodiversity and ecosystem issues as a barrier impeding companies from effectively determining risk and opportunity exposures. So too is a lack of awareness among accounting and business communities of natural capital issues.

Given the importance of biodiversity and ecosystems to business and society, the accountancy profession has an important role to play in raising awareness of the business case, and developing new valuation, accounting, and reporting approaches.

Organizations can position themselves for sustainable success by ensuring that risk and materiality assessments consider natural capital, and by going through a process of placing monetary values or measurements on what nature does for their business models. This leads to better business decision making by exposing significant costs and benefits that could materially impact the bottom line but that traditional financial analyses usually miss.

This eNews highlights what is being done and by whom to develop natural capital accounting as an integrated part of business decision making and reporting.

3. A Macro View of Natural Capital Risk

Trucost’s study, Natural Capital at Risk: The Top 100 Externalities of Business, provides a high-level indication of the priority sectors and regions where natural capital risk lies and, therefore, the largest natural capital risks and opportunities for business and investors. Highest impact externalities are the primary production (agriculture, forestry, fisheries, mining, oil and gas exploration, utilities) and primary processing (cement, steel, pulp and paper, petrochemicals) sectors analyzed and are estimated to have externality costs totaling US$7.3 trillion, which equates to 13% of global economic output in 2009. The value of the Top 100 externalities is estimated at US$4.7 trillion or 65% of the total primary sector impacts identified.

The majority of environmental externality costs are from greenhouse gas emissions (38%) followed by water use (25%), land use (24%), air pollution (7%), land and water pollution (5%), and waste (1%). The report assessed more than 100 environmental impacts using the Trucost environmental model, which condenses them into six Environmental Key Performance Indicators (eKPIs) to cover water use, greenhouse gas (GHG) emissions, waste, air pollution, water and land pollution, and land use.

4. Business Case for Natural Capital Management

Organisational Change for Natural Capital Management, released by The Economics of Ecosystems and Biodiversity (TEEB) for Business Coalition, describes how business leaders can strategize and implement changes in organizational behavior related to valuing natural capital in their companies. The findings are threefold.

- A small group of pioneering companies who recognize the growing business case are moving natural capital management forward and expect to embed it into their business within the next three years. The rationale is they will be much better positioned than other companies to manage and thrive in the resource-constrained world. In particular, availability of freshwater, renewable energy, climate regulation, fiber, and food were identified as the most important natural capital risks over the next 3-5 years.

- Delaying the measurement and management of natural capital carries a significant business risk for companies in terms of the availability of key raw materials and maintaining sustainable competitive advantage.

- Current barriers to change at the organizational level include a lack of harmonized methods to measure, prioritize, and integrate natural capital into the business and organizations analyzing their impacts beyond their organizational boundary into their supply chains.

The 24 companies featured in the Corporate EcoForum report, The New Business Imperative: Valuing Natural Capital, are taking a lead by uniting in the view that immediate leadership to safeguard well-functioning ecosystems is a business imperative, not a matter of philanthropy. Companies cited in the report include Puma, Nike, Lockheed Martin, GM, Disney, Enterprise, TD, Coca Cola, Patagonia, Xerox, Unilever, Kimberly-Clark, and Marriott.

5. The TEEB for Business Coalition

The TEEB for Business Coalition is developing tools and guidance to successfully incorporate natural capital into strategy and decision-making processes. This involves companies reflecting the true social and environmental costs of depleting natural capital and creating benefits, such as restoring natural environments and developing social and human capital. The coalition is a global platform for supporting the development of widely agreed-on methods for natural and social capital valuation in business. This work involves considering a valuation framework that can define what to measure and why.

A number of organizations are supporting the coalition, including the Institute of Chartered Accountants in England and Wales (a founding member), IFAC, the Chartered Institute of Management Accountants, the World Business Council for Sustainable Development, the International Union for Conservation of Nature, the World Wildlife Fund UK, and the Global Reporting Initiative, all of which are engaged in developing and furthering the coalition. IFAC is represented by PAIB Committee member Ian Rushby, who is also a trustee of the International Institute for Environment and Development.

TEEB for Business Coalition is holding its annual conference in Singapore November 18-19, 2013, in conjunction with the Responsible Business Forum. Additional details will be shared in later issues of the PAIB Committee’s eNews and on the TEEB for Business Coalition website.

6. Tracking a Carbon Bubble

The Carbon Tracker Initiative report, Unburnable Carbon, calculates that only 31% of the world's currently indicated fossil fuel reserves, which equate to 2,860bn tonnes of carbon dioxide, could be burned for an 80% chance of keeping below a 2°C global temperature rise, which is commonly regarded as the threshold within which to avoid dangerous climate change. For a 50% chance of 2°C or less, only 38% could be burned.

This information has potentially significant implication for loss of value to investors given how far reaching carbon is for financial markets—the top 100 coal and top 100 oil and gas companies have a combined value of US$7.42 trillion as of February 2011. Additionally, the countries with the largest greenhouse gas potential in reserves on their stock exchanges are Russia, the United States, and the United Kingdom and the stock exchanges of London, Sao Paulo, Moscow, Australia, and Toronto all have an estimated 20-30% of their market capitalization connected to fossil fuels. Carbon and fossil fuels, and decisions regarding their use and value, can have significant impacts on financial markets and futures around the world.

This carbon bubble leads to a reporting challenge, particularly for fossil fuel companies. For these companies, it is not necessarily the scale of operational emissions that is the strategic challenge but the emissions associated with their products, which are currently locked into their reserves. The potential carbon footprints of reserves may not be adequately transparent with obsolete data masking the full risks facing fossil fuel reserves. Consequently, companies need to consider moving beyond simply annually reporting last year’s emissions flows to a more forward-looking analysis of carbon stocks.

7. Innovative Organizations

Becoming Net Positive

An increasing number of companies, including Coca Cola and retail organizations Kingfisher and Ikea, are striving to become net positive, which means that they will give back more than they take in relation to critical environmental and social factors upon which their business models depend.

For example, for a do-it-yourself (DIY) business such as Kingfisher, timber is an essential raw material. It depends on a forest area approximately the size of Switzerland. It aspires to create more forest than it needs to develop products. Beyond timber, Ikea strives for resource independence, by encouraging all waste be turned into resources; energy independence, by being a leader in renewable energy, and becoming more energy efficient throughout its operations and supply chain. Coca Cola aims to return as much water to nature as it uses in its products and their production.

Indian conglomerate ITC reports that it is carbon positive (by sequestering or storing twice the amount of carbon dioxide emissions that it emits through, for example, farm forestry initiatives, which add to plantation sizes); water positive (by creating three times more rainwater harvesting potential than the net water consumed by its operations); and waste positive (by recycling its own paper and fly ash, a byproduct of coal combustion, as well as buying other company’s waste paper to use in its paperboard operations).

The key success factors behind such initiatives include:

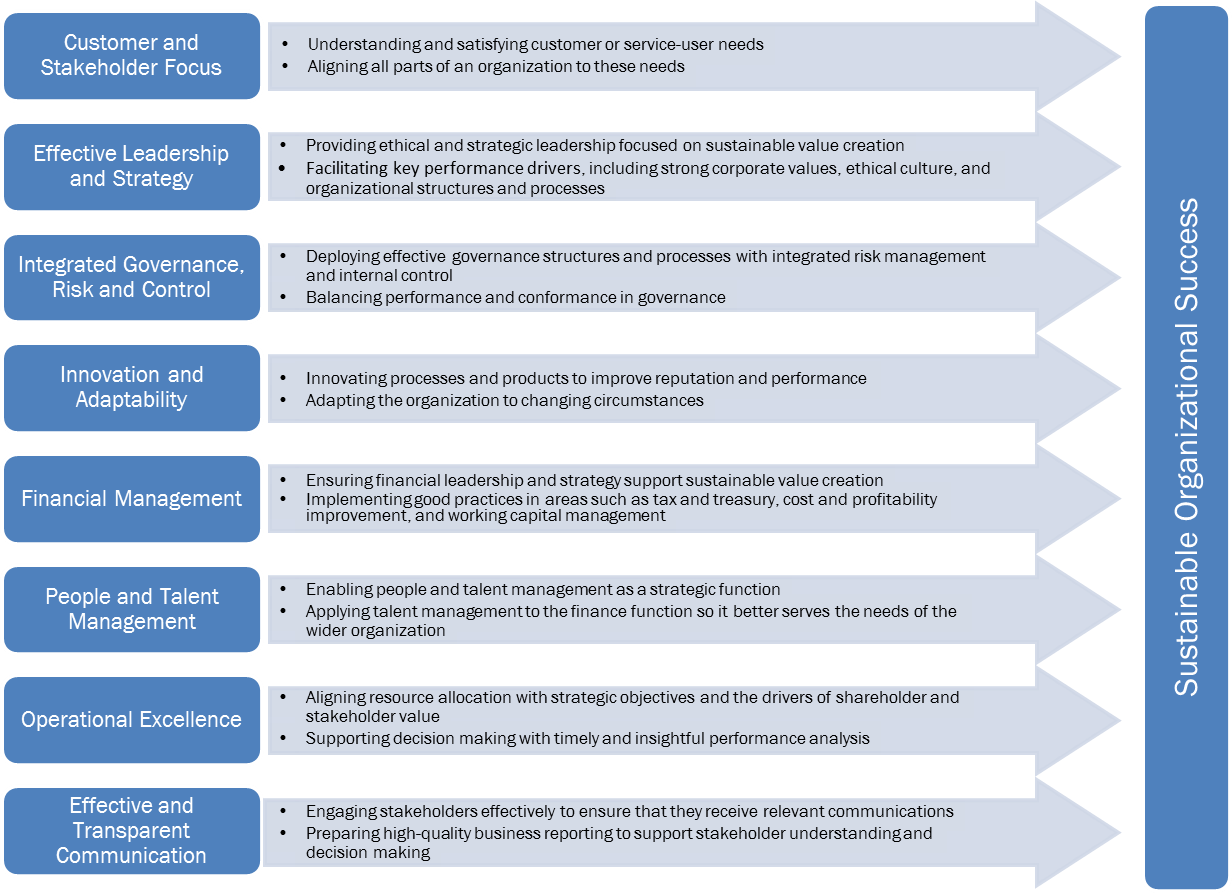

- providing vision, leadership, and commitment from the top of the organization to be sustainably successful;

- applying a financial mindset by establishing a business case and understanding how sustainability actions contribute directly to business value, either through revenue generation, cost control, risk management, or innovation;

- setting aspirational and challenging goals and targets;

- connecting sustainability goals to strategy by identifying significant drivers and subjecting these aspects to a systematic management process that involves setting and cascading targets and performance measures to facilitate the delivery of vision and strategy;

- collaborating closely with customers and suppliers;

- measuring the drivers of business externalities, such as greenhouse gas emissions and resulting impacts, such as climate change (this involves data collection, analysis, and interpretation, and integrating data requirements into management and/or accounting systems); and

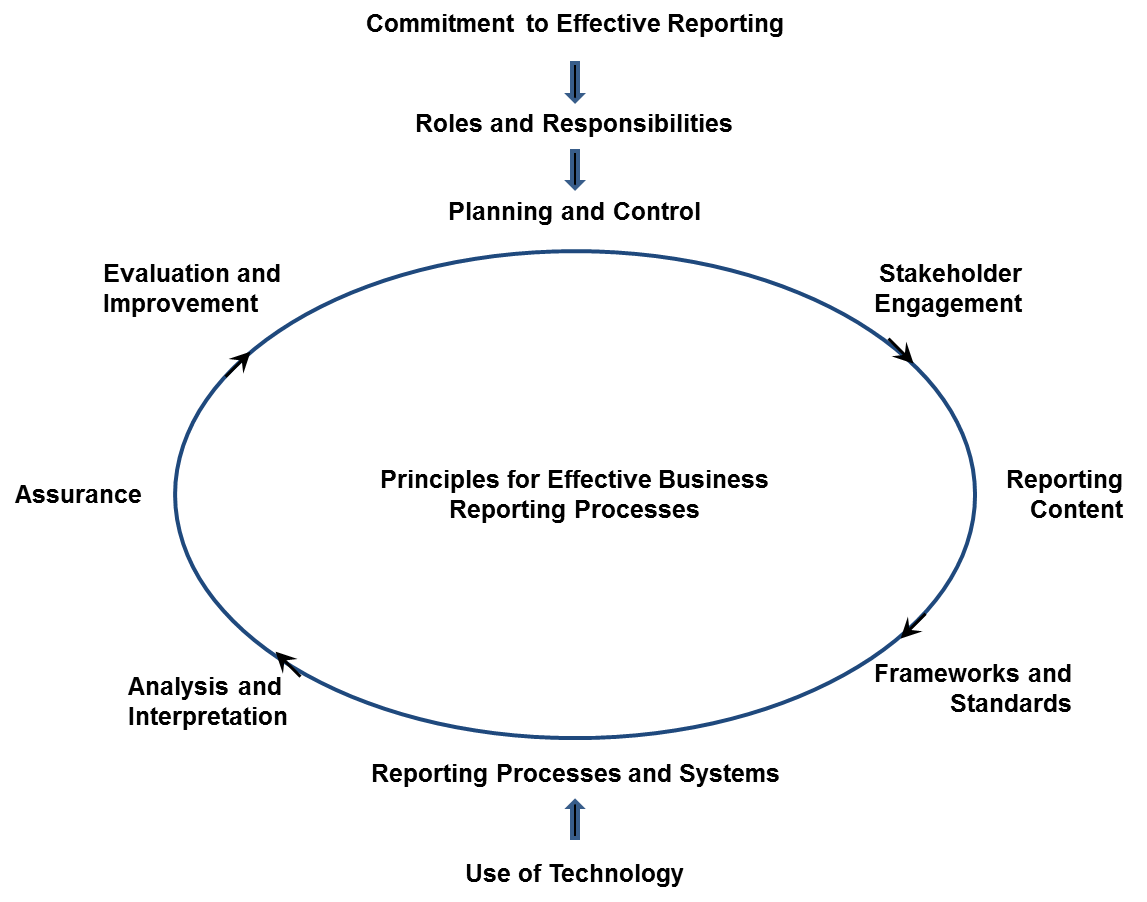

- communicating with stakeholders through high-quality reports and disclosures.

An Innovative Approach to Disclosure: PUMA Environmental P&L Methodology

In 2011, PUMA became the first major company to release an environmental profit and loss (P&L) statement and put an economic value on greenhouse gas emissions and water consumption (see PAIB Committee eNews July 2011 for more information). PUMA started on its journey to establish how much it would need to pay for the services nature provides so that PUMA can produce, market, and distribute footwear, apparel, and accessories made of leather, cotton, rubber, or plastic for the long term. A P&L methodology utilizes the essence of an accounting framework when monetizing environmental impacts. The economic valuation of PUMA’s environmental impact provides a wake-up call and reveals where it has to direct its sustainability initiatives to make real improvements in reducing its footprint. These include identifying more sustainable materials, investigating the development of broadly-accepted definitions of sustainable cotton and rubber, and looking for additional opportunities to reduce greenhouse gas emissions and other environmental impacts.

8. Other Activities and Resources

- Corporation 2020 is a movement that calls for new ways for corporations to operate given that the legal status and business persona of today’s corporation are almost a hundred years old.

- Forum for the Future is an independent non-profit that works globally with business and government to inspire new thinking, build creative partnerships, and develop practical solutions.

- Global Reporting Initiative (GRI)’s Approach for Reporting on Ecosystem Services: Incorporating Ecosystem Services into an Organization’s Performance Disclosure suggests indicators organizations could use to assess and report their impacts on ecosystem services. In cooperation with the United Nations Environment Programme’s World Conservation Monitoring Centre and the Dutch consultancy firm CREM, GRI highlights approaches for developing sustainability reporting indicators to help companies report their impacts and reliance on ecosystem services. Additionally, the fourth generation of the GRI’s Sustainability Reporting Guidelines (G4) is available on the GRI website.

- Natural Capital Declaration is a declaration by finance-sector CEOs representing commitments made at the Rio+20 Earth Summit to work toward integrating natural capital considerations into financial products and services. The Declaration is convened and facilitated by the United Nations Environment Programme Finance Initiative, the Global Canopy Programme, and the Center for Sustainability Studies of the Business Administration School of the Getulio Vargas Foundation.

- The Prince of Wales’ Accounting for Sustainability Project includes an initiative on valuing natural capital and is a co-founding member of the TEEB Business Coalition.

- The B Team is a not-for-profit initiative that has been formed by a group of global business leaders to create a future where the purpose of business is to be a driving force for social, environmental, and economic benefit.

- UK Department for Environment, Food, and Rural Assets (DEFRA)’s Ecosystem Markets Task Force was established to respond to the continuing degradation of ecosystems and loss of biodiversity and highlights efforts by the UK government to become a global leader in measuring natural capital.

- World Bank Wealth Accounting and the Valuation of Ecosystem Services (WAVES) is a global partnership to promote sustainable development by ensuring that the national accounts used to measure and plan for economic growth include the value of natural resources.

- The World Business Council for Sustainable Development (WBCSD)’s Framework for Corporate Ecosystem Evaluation provides a framework for improving corporate decision making through valuing ecosystem services. The guide puts into operation TEEB’s Mainstreaming the Economic of Nature, released in October 2010, which also includes reference to the international mining company Rio Tinto, which adopted a net positive impact on biodiversity as a long-term goal.

- WBCSD also recently published Eco4Biz: Ecosystem Services and Biodiversity Tools to Support Business Decision Making. The report provides a guide to help companies sift through an emerging family of tools to help them assess and manage their impacts and dependencies on natural capital. Eco4Biz also features a decision tree with two questions corporate managers might ask: a) At what scale would you like to carry out an assessment—global, landscape (including individual site and portfolio of sites), or product level? and b) What outputs would best support your decision-making—a map (including supporting reports), a quantitative value, or a score showing priority areas?